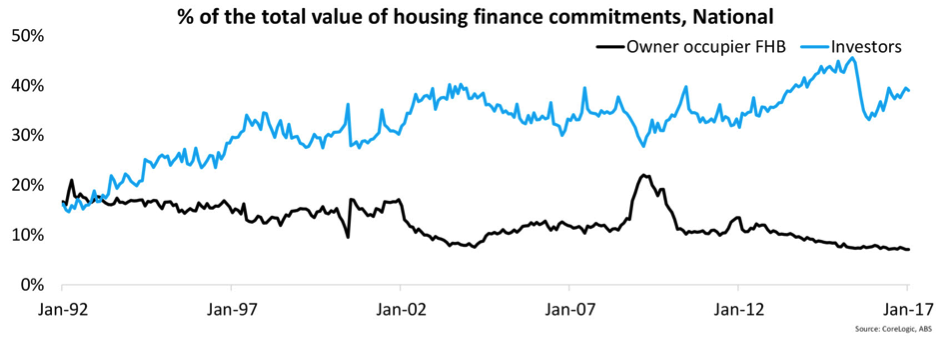

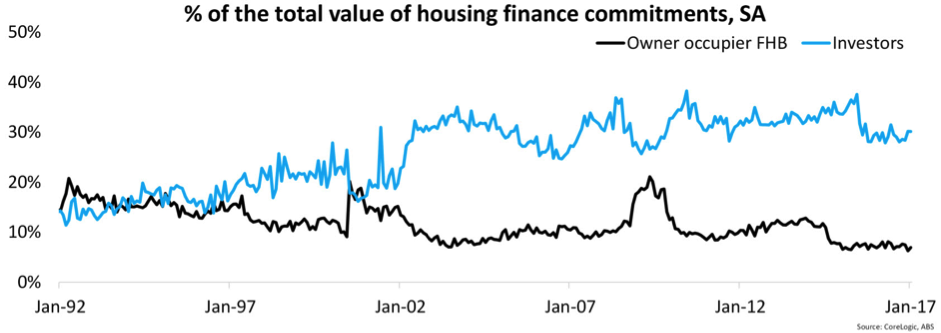

According to Core Logic, there has been a drop in First Home Buyer participation in the property market, while there has been a surge in investor activity. The graph below clearly demonstrates this.

Although this is a national trend, it has been accelerating since 1992, especially during periods of high growth where investors have been active. I hear from many clients, friends and especially the media and now the government that first home buyers can no longer afford property due to the massive increases in property price growth. However, if we look at South Australia as an example where property prices have not set the world on fire, the trend is similar of late. Interest rates have been falling making it more affordable for all buyers, especially FHB.

Last week, my wonderful wife and much better half got her bank card stuck in the ATM upstairs. After sitting there for 10 minutes waiting for the machine to stop running wild, she signalled to a young man working in the CBA branch at Westfield Parramatta. He came over to assist and after a general chat, they got onto the topic of property. The young man looks after mortgages for that branch. He mentioned that the CBA has excellent budgeting tools that he offers to his younger clients around his age in their 20’s and 30’s. They find it difficult to save, even though they are on good incomes. He put it down to the younger generations easy access to money. I would add the increasing materialism over the last three decades and the need to have everything immediately instead of saving for it. With new technology like Paypass and Applepay increasing in popularity, the easy access to credit and funds without having to pull money out of your wallet, ATM or over the counter at the bank there is serious ramification for the ability of the younger generation to save.

When I bought my first property in my early 20’s, I was the same. A young successful corporate accountant on a high income, but with $10K on my credit card and another $10K personal loan. When the property behind my parents’ house came up for sale, my late father wanted me to buy it. I couldn’t, even though the major banks were proving 95% loans with no mortgage insurance, I didn’t even have that 5% and the stamp duty available. My father made me organise the loan before the auction and my parents put their house up to provide the equity. He went with me to the auction and kept nudging me in the ribs to continue bidding, even though it went above what I wanted to spend. My mother nearly had a heart attack, but he kept making me bid saying it was worth more to me considering it backed onto their property than the other bidder. I ended up buying it. He helped me renovate it. I made the repayments on time and have done so for the last 18 years. The bank doesn’t wait for their money and that made me start to save and soon enough within 12 months was also able to clear my personal loan and credit card debt along with maintaining my mortgage repayments. I didn’t sit home and just save, I continued enjoying my life, just within reason. Since then, I have accumulated assets including property and in a much better position than I would have been if my father had allowed me to continue on my merry way.

The take-out message for those with children or the younger generation looking to buy into the property market, get some assistance. Speak with your accountant or financial planner to assist with budgeting and education around saving for investments. For the parents, let your children prove that they are committed to saving, then assist them buy that first property by providing the security or a deposit to help. It can be an investment, it doesn’t have to be an owner-occupied residence. It doesn’t need to be in the suburb, city or even state you live in. Do your research or engage someone that can assist. Just get started in creating equity through investments and the discipline which will hold them in good stead. A great book to read to read and to give to your children is The Richest Man in Babylon by George S Clason. It is simply written, a bit like a parable, but the message is simple and reinforces the need to save and invest those savings with the power of compounding. A must read of any avid investor and the best $10 you will ever spend. For a comprehensive budgeting spreadsheet to download CLICK HERE.