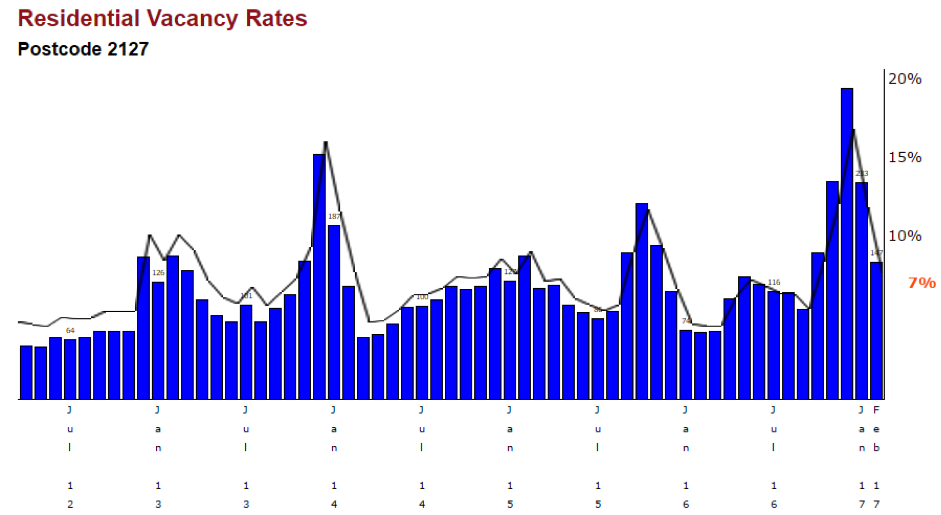

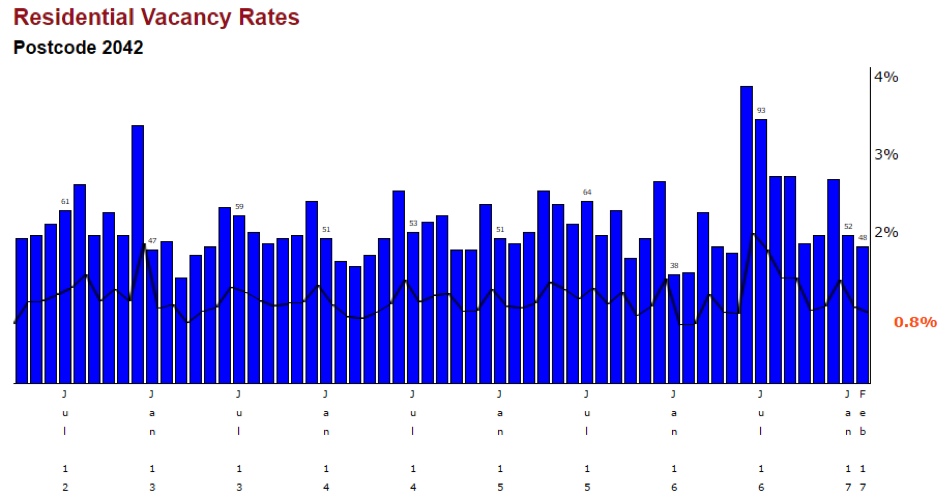

Selecting suburbs with superior capital growth potential is essential to pinpoint where the best opportunities are. You could’ve thrown a dart on a map of Sydney 5 years ago and bought where it landed and experienced capital growth. However, some suburbs have outperformed others. Supply and demand plays a major part. Wentworth Point in Sydney has had a massive supply of apartments over the last 5 years. Overseas investors have paid massive premiums for new apartments, way above what a similar second hand apartment is worth. Why? They must buy new and many developers have capitalised and made massive profits selling run of the mill investor type properties. Result, average median price growth in apartments has averaged just 3.23% over the last 10 years. Compare that to Newtown, a suburb I share a love/hate relationship with. Excellent for investment, but I avoid it for dining and leisure time due to it being “not my scene” and extremely busy. Apartments in Newtown have averaged 9% per annum growth over the same 10 year period. Not bad at all and almost three times that of Wentworth Point. Considering Sydney property did very little between the previous peak of 2003/4 and 2009/10, that is excellent growth over the last 5 years. Over the shorter term, the median 5-year growth for Newtown is 74% compared to 39% for Wentworth Point. Add that to that a current 7% vacancy rate for the Wentworth Point post code (down from 17% in December!) compared to the postcode for Newtown sitting at 0.8% currently. Some research companies suggest the vacancy rate for Wentworth Point to be as high as 24% if you take into account the unadvertised new apartments not listed on real estate portals.

The infrastructure is much better in Newtown, be that transport, schools and universities. You have access to the largest employment node, the Sydney CBD. Ample restaurants, cafes, theatres and other recreational and social amenities. No wonder the Commonwealth bank announced a couple of years back it was moving its Olympic Park offices back towards the CBD to Redfern. We are a service dominated economy. Attracting the right workforce for large financial services companies like the CBA is important. The younger generation are all about lifestyle and pastimes like eating “smashed avocado” for breakfast as the demographer Bernard Salt coined recently. Grungy and happening Newtown isn’t for boring old me. However, I am not the one buying close to the CBD to live, it is the singles and childless couples on great incomes that demand to buy and live in close proximity to their jobs and social venues. Newtown has had limited supply and high demand and has as such experienced excellent capital growth. Wentworth Point is an area I like to visit and dine at its cafes and restaurants, but for residents it has limited infrastructure and a massive supply of new residential property. As such, capital growth has severely underperformed the Sydney market. There was no shortage of project marketers and self-proclaimed investment property experts selling these apartments. Many local investors got caught up in the marketing hype and the fear of missing out.

Vacancy Rates for Postcode 2127 – Source SQM Research

Vacancy Rates for Postcode 2042 – Source SQM Research